Cost of Living Adjustments for 2023

Save even more for retirement in 2023 due to record breaking increases in limits.

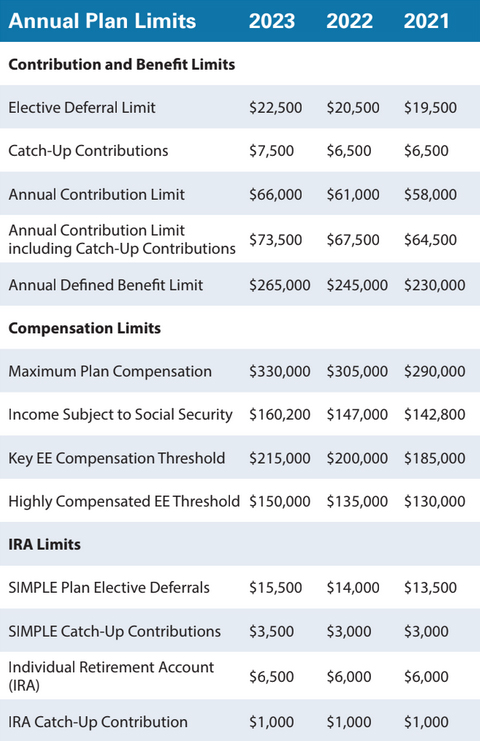

On October 21, 2022, the IRS announced the Cost of Living Adjustments (COLAs) affecting the dollar limitations for retirement plans for 2023. Retirement plan limits increased well over the 2022 limits, the largest increase in over 45 years. COLA increases are intended to allow participant contributions and benefits to keep up with the “cost of living” from year to year. Here are the highlights from the new 2023 limits:

- The calendar year elective deferral limit increased from $20,500 to $22,500.

- The elective deferral catch-up contribution increased from $6,500 to $7,500. This contribution is available to all participants aged 50 or older in 2023.

- The maximum available dollar amount that can be contributed to a participant’s retirement account in a defined contribution plan increased from $61,000 to $66,000. The limit includes both employee and employer contributions as well as any allocated forfeitures. For those over age 50, the annual addition limit increases by $7,500 to include catch-up contributions.

- The maximum amount of compensation that can be considered in retirement plan compliance has been raised from $305,000 to $330,000.

- Annual income subject to Social Security taxation has increased from $147,000 to $160,200.

New Plan Year Checklist

Each year, a great deal of attention is paid to the upcoming year end work: census gathering, compliance testing, 5500s, oh my! But the year-end also brings with it a host of items that may need attention before the year closes. Below are a few action items that may need to be considered.

- Changes were made for the current plan year or upcoming plan year that required an amendment. Example: As of January 1, 2023, in-service distributions are available to participants at age 59 1⁄2.

- Do you have a signed copy of the amendment on file?

- Have you revised your processes to ensure you are following the new terms of the plan?

- Are there terminated participants with small balances?

- If your plan is like most and permits force-out or mandatory distributions of terminated participant account balances, the distributions must be completed by the plan year end.

- Check with your service provider to ensure the amounts will be paid out before the current plan year end.

- If your plan includes automatic enrollment provisions, the following may help you keep on track.

- Identify participants who will be eligible at the start of the plan year and be sure that deferrals are scheduled to begin on time for those that do not opt out.

- For plans that include auto-escalation of contributions, create a list of participants whose deferrals need to be increased in accordance with the plan’s schedule.

- With the significant increase in limits for 2023, it will be a great year for both participants and plan sponsors to take advantage of saving for retirement. It may make sense to review your current plan specifications to ensure that participants can take advantage of the higher limits. Some examples are raising your company match cap to a higher limit or letting employees enter the plan more quickly.

- The 2023 COLAs significantly raised the annual compensation limit from $305,000 to $330,000. If you fund employer contributions during the year, be sure to adjust your calculations for the upcoming plan year based upon the new limit.

- While some actions are needed ahead of the start of a plan year, the SECURE Act provided that a new plan can be added after the end of the year to which it applies. For example, if you maintain a 401(k) Plan and choose to add a Cash Balance Plan, the new plan can be implemented up to the due date of the company’s tax filing. This means that even if you choose to add a Cash Balance Plan for 2022, the plan document can be executed in 2023 if it’s adopted prior to filing the 2022 company tax return.

Be sure to speak with your TPA or service provider about any additional steps that need to be taken in order to be ready for a new plan year.

Save or Toss? Proper Plan Record Storage a Must!

As the year comes to a close, you may wonder what plan records must be kept and what items can be tossed. Historical plan records may need to be produced for many reasons: an IRS audit, a DOL investigation or simply questions from participants about their benefits or accounts to name a few.

The Internal Revenue Service (IRS) takes the position that plan records should be kept until all benefits have been paid from the plan and the audit period for the final plan year has passed. This additional audit period is important to note. It may seem that with the final payout the plan is gone, but the reality is that the plan can be selected for audit for 6 years after the plan assets are paid out and your final Form 5500 is filed. The items that are typically needed in the event of an audit are:

- Plan documents and amendments (all since the start of the plan, not just the most recent)

- Trust Records: investment statements, balance sheets and income statements

- Participant records: Census data, account balances, contributions, earnings, loan records, compensation data, participant statements and notices

Under the Employee Retirement Income Security Act (ERISA), the following documentation should be retained at least six years after the Form 5500 filing date, including, but not limited to:

- Copies of the Form 5500 (including all required schedules and attachments)

- Nondiscrimination and coverage test results

- Required employee communications

- Financial reports and supporting documentation

- Evidence of the plan’s fidelity bond

- Corporate income

In addition, ERISA states that an employer must maintain benefit records, in accordance with such regulations as required by the Department of Labor (DOL), with respect to each of its employees that are sufficient to determine the benefits that are due or may become due to such employees. These items don’t necessarily have a set time frame, so you may want to consider keeping these items indefinitely. Documentation needed may include the following:

- Plan documents, amendments, SPD, etc.

- Census data and supporting information to determine eligibility, vesting and calculated benefits

- Participant account records, contribution election forms and beneficiary forms

- Documentation related to loans and withdrawals

It is the plan sponsor’s responsibility to ensure documentation is kept regardless of which service providers are used during the life of the plan. Establishing a written process regarding how long to keep documentation is important as well as giving careful thought to whether the records will be electronic or paper. This ensures that, as staff members change over time, your processes will remain consistent and all necessary information will be handled appropriately. When storing plan records electronically, consider a naming convention that will make documents accessible to the proper personnel and easy to locate.

Security of the information should be considered as well to protect the confidentiality of personally identifiable information or PII. Many types of plan records include items considered PII, like social security numbers, dates of birth or account numbers. This information should be kept in a secure manner to avoid the possibility of identity theft and fraud. Take the necessary steps to ensure that the plan’s service providers also have adequate policies in place to protect participant’s PII as well.

Deadline for CARES Act and SECURE Act Amendments Extended

The original due date of the CARES Act and SECURE Act amendments for qualified plans, other than governmental plans, was the last day of the first plan year beginning on or after January 1, 2022, which means December 31, 2022, for calendar year plans. This has been extended to December 31, 2025, regardless of plan year end. However, the deadline for governmental plans (414(d) plans, 403(b) plans maintained by public schools or 457(b) plans) is 90 days after the close of the third regular legislative session of the legislative body with the authority to amend the plan that begins after December 31, 2023.

This does not restore the availability of Coronavirus Related Distributions or larger loan limits but refers to the amendments that document the provisions used to operate the plan. Check with your TPA or document provider to confirm if the amendments for your plan were already filed or if the extended deadline will apply to you.

Upcoming Compliance Deadlines for Calendar-Year Plans

December 1st

Participant Notices – Annual notices due for Safe Harbor elections, Qualified Default Investment Arrangement (QDIA), and Automatic Contribution Arrangements (EACA or QACA).

December 30th

ADP/ACP Corrections – Deadline for a plan to make ADP/ ACP corrective distributions and/or to deposit qualified nonelective contributions (QNEC) for the previous plan year.

Discretionary Amendments – Deadline to adopt discretionary amendments to the plan, subject to certain exceptions (e.g., anti-cutbacks).

Required Minimum Distribution (RMD) – For participants who attained age 72 in 2021 (and attained age 70 on or after July 1, 2019), the first RMD was due by April 1, 2022. The 2nd RMD, as well as subsequent distributions for participants already receiving RMDs, is due by December 30, 2022.

January 31st

IRS Form 945 – Deadline to file IRS Form 945 to report income tax withheld from qualified plan distributions made during the prior plan year. The deadline may be extended to February 10th if taxes were deposited on time during the prior plan year.

IRS Form 1099-R – Deadline to distribute Form 1099-R to participants and beneficiaries who received a distribution or a deemed distribution during prior plan year.

IRS Form W-2 – Deadline to distribute Form W-2, which must reflect aggregate value of employer-provided employee benefits.