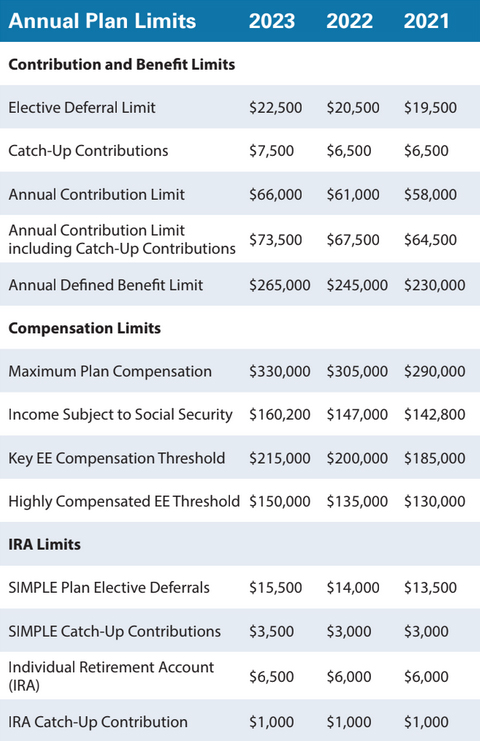

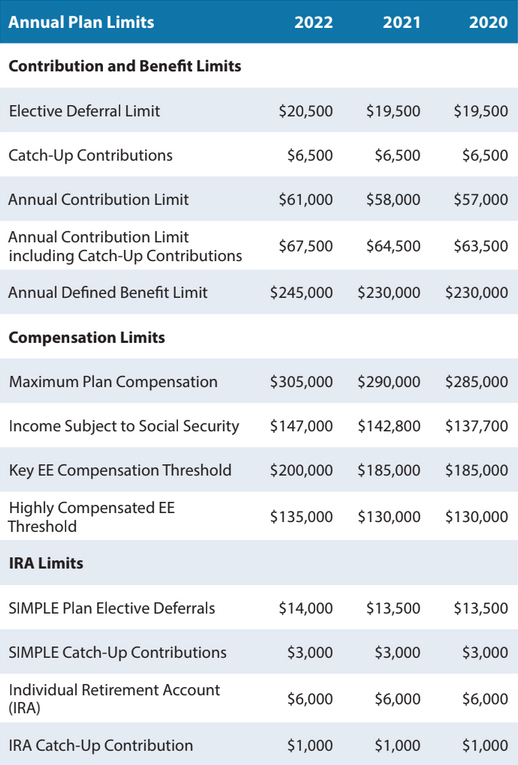

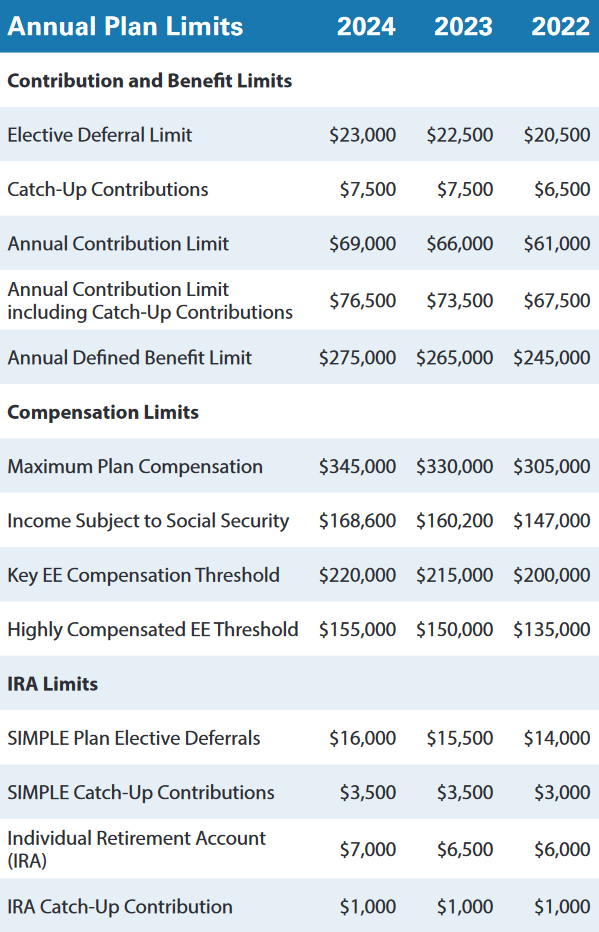

On November 1, 2023, the IRS announced the Cost of Living Adjustments (COLAs) affecting the dollar limitations for retirement plans for 2024. In October, the Social Security Administration announced a modest benefit increase of 3.2%. Retirement plan limits also increased over the 2023 limits. COLA increases are intended to allow participant contributions and benefits to keep up with the “cost of living” from year to year. Here are the highlights from the new 2024 limits:

- The calendar year elective deferral limit increased from $22,500 to $23,000.

- The elective deferral catch-up contribution remains $7,500. This contribution is available to all participants aged 50 or older in 2024.

- The maximum available dollar amount that can be contributed to a participant’s retirement account in a defined contribution plan increased from $66,000 to $69,000. The limit includes both employee and employer contributions as well as any allocated forfeitures. For those over age 50, the annual addition limit increases by $7,500 to include catch-up contributions.

- The maximum amount of compensation that can be considered in retirement plan compliance has been raised from $330,000 to $345,000.

- Annual income subject to Social Security taxation has increased from $160,200 to $168,600.

Considering Changes to Your Business? Don’t Forget About Your Plan!

In today’s changing work environment, the sale or purchase of another business is not uncommon. If you’re planning to make changes to your business structure, remember to include the retirement plan in your negotiations. The type of sale can have a major impact on your plan, so it is highly recommended that you understand which type you are considering and notify your Third Party Administrator before taking action.

There are two types of sale transactions that affect the future of a retirement plan: asset sale and stock sale. Let’s take a look at some terminology that may be unfamiliar, so that if you do find yourself in a merger or acquisition situation, you will know what to expect. For this discussion, For Sale is being sold to Buyer, and both firms sponsor retirement plans.

An asset sale is the sale of assets belonging to the business, but not the business itself. In this scenario, For Sale’s retirement plan stays with For Sale; the retirement plan is not one of the assets being sold. For Sale may continue to operate normally and may continue to sponsor the retirement plan. For Sale may also terminate the plan. If For Sale continues to sponsor the plan, there may be a partial plan termination. Partial plan terminations will be discussed later in this article.

- In an asset sale, if For Sale’s employees are hired by Buyer, they are considered new employees, and are subject to the eligibility and entry requirements for Buyer’s plan. Buyer may waive these requirements, but the plan will need to be amended to do so. A former For Sale employee now working for Buyer may keep their account balance with the For Sale plan if it is not terminated or move their balance to the Buyer plan. If they decide to do the latter, it will be a distribution and a rollover—not a transfer. The former For Sale employee may also pursue other distribution options, per For Sale’s plan document.

A stock sale is the sale of the business itself. In this scenario, For Sale is wholly owned by Buyer. During negotiations, the disposition of the plan should be discussed. The plan can be terminated prior to the sale, merged into the Buyer plan after the sale, or continue as-is under Buyer.

- If the plan is terminated prior to the date of sale, the participants are all considered 100% vested in their account balances and can take a distribution from the plan. A Form 5500 would need to be filed for each plan year until all distributions are complete and the assets are reduced to $0.

- The plans can be merged into one plan after the sale. This may result in one plan being merged directly into the other, or both plans being combined into an entirely new plan. Care should be taken to preserve protected benefits. Additionally, in a merger situation, if either plan is affected by a compliance issue, the issue will persist into the merged plan.

The For Sale plan could continue with Buyer as the sponsor. In this case, there will be a transition period, during which the plans continue to be tested separately for coverage. This transition period lasts until the plan year end following the year of purchase, after which the plans must be tested together. For a calendar-year plan purchased July 1, 2023, the transition period would end December 31, 2024. Operating two plans in this manner is often more expensive and may result in coverage testing being more difficult to pass.

If the For Sale plan is retained through the purchase, and is then terminated at a later time, the plan is subject to the successor plan rule. This rule was established to prevent participants from taking distributions of their deferrals prior to age 59½. The basic rule states that the participants of the terminated plan can’t participate in another 401(k) plan sponsored by the same employer for 12 months following the termination date. As the For Sale plan is sponsored by Buyer post-sale, the For Sale participants wouldn’t be able to participate in the Buyer plan for a year after the termination of the For Sale plan. If the intention is to terminate the For Sale plan, it may be best to do so before completion of the purchase.

Sometimes, the sale might be for just a portion of a business’s ownership; other times, ownership is purchased by more than one individual. In these cases, the companies may become part of a controlled group. If a controlled group exists, the plans must be combined to pass coverage testing. The number of owners and their ownership percentages could impact testing and will likely require closer attention to be paid.

A change in ownership can also affect whether a selling or buying company becomes part of an affiliated service group (ASG). An ASG could exist when a significant portion of the business of any company is the performance of services for another related company. Plans impacted by an ASG will be considered one group for coverage testing.

If only part of a company is sold, there may be a partial plan termination. The determination of a partial plan termination is based on the facts and circumstances of the situation, but as a general rule, if at least 20% of the plan participants are involuntarily terminated due to events related to the purchase, those affected participants are considered 100% vested in their accounts.

This is not intended to be legal advice. Consulting with an attorney is highly recommended prior to making any decisions for your business. Your participants’ eligibility for transaction-related distributions should be discussed in detail before any funds leave the plan. Your Third Party Administrator can help you navigate the process to understand which type of sale you may be part of and how it could affect your plan and participants.

Good News on Catch-Up Contributions!

Catch-up contributions are additional employee deferrals that can be made to 401(k), 403(b) and governmental 457 plans for those participants who are age 50 or older. These contributions can be made on a pre-tax or Roth (after-tax) basis.

As originally laid out in the SECURE 2.0 Act of 2022, catch-up contributions for those earning over $145,000 in the prior year would need to be Roth deferrals starting in 2024. However, the Internal Revenue Service (IRS) recently announced a transition period that will delay this requirement until 2026. While there was previously some confusion as to whether the new law eliminated all other catch-up contributions, the IRS has since confirmed that catch-up contributions can continue to be made by all age-eligible participants if allowed by the plan document. The deferrals can continue to be either pre-tax or Roth.

For 2024, the maximum deferral contribution is $23,000 and the maximum catch-up contribution is $7,500.

News Alert: Grace Period Extended for EFAST2 Login Credentials

If you electronically sign your Form 5500 through the ERISA Filing Acceptance System (EFAST2) and haven’t yet obtained new credentials from www.login.gov, you will need to do so by December 31, 2023. This date extends the original September 1 deadline. The new credentials established during this transition can be used across many government services. If you do not currently have login credentials for EFAST2, this action item does not apply to you.

Upcoming Compliance Deadlines for Calendar-Year Plans

December 1st

Participant Notices – Annual notices due for Safe Harbor elections (note that some plans are no longer required to distribute Safe Harbor notices), Qualified Default Investment Arrangement (QDIA), and Automatic Contribution Arrangements (EACA or QACA).

December 29th

ADP/ACP Corrections – Deadline for a plan to make ADP/ ACP corrective distributions and/or to deposit qualified nonelective contributions (QNEC) for the previous plan year.

Discretionary Amendments – Deadline to adopt discretionary amendments to the plan, subject to certain exceptions (e.g., anti-cutbacks).

Required Minimum Distribution (RMD) – For participants who reached age 72 in 2022, the first RMD was due by April 1, 2023. The 2nd RMD, as well as subsequent distributions for participants already receiving RMDs, is due by December 29, 2023. Participants who were at least age 73 and terminated in 2023 may take their first RMD by April 1, 2024.

Contribution Funding – Final funding deadline for 2022 plan year end. See your tax advisor for year of deductibility.

January 31st

IRS Form 945 – Deadline to file IRS Form 945 to report income tax withheld from qualified plan distributions made during the prior plan year. The deadline may be extended to February 10th if taxes were deposited on time during the prior plan year.

IRS Form 1099-R – Deadline to distribute Form 1099-R to participants and beneficiaries who received a distribution or a deemed distribution during the prior plan year.

IRS Form W-2 – Deadline to distribute Form W-2, which must reflect the aggregate value of employer-provided employee benefits.